is a car an asset for medicaid

The state sets the income and resource limit each year. C One automobile is excluded for the individual regardless of.

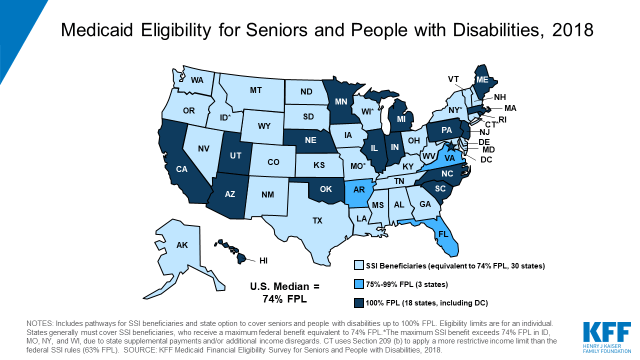

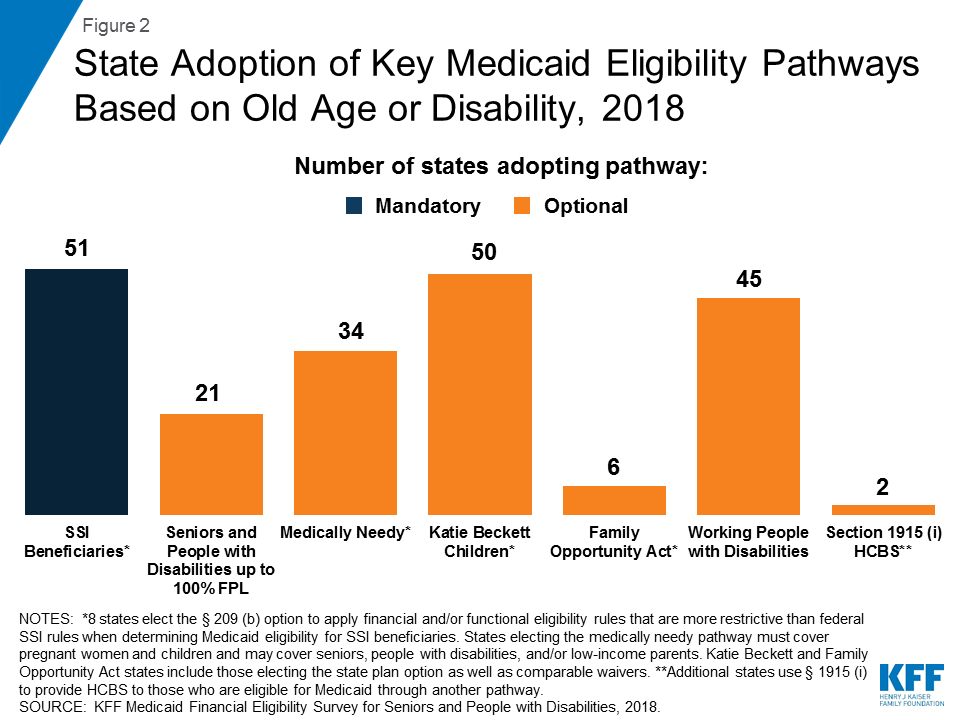

Medicaid Financial Eligibility For Seniors And People With Disabilities Findings From A 50 State Survey Issue Brief 9318 Kff

It can include in addition to cars and trucks.

. Can I own a car and qualify for Medicaid. Medicaid will include the cash value of a life insurance policy over 1500 in their asset test although in a few states this amount varies. An important change is coming in 2022.

However the older vehicles may be included if the vehicle is 1. If you own a car you can rest assured Medicaid is not going to hold it against you no matter how much it costs. Because Medicaid is a needs-based program you must pass the income and asset eligibility requirements.

This could even be a Lamborghini. For 2021 New York automatically excludes applicants with assets above 15900 for an individual and 23400 for a family. After the first vehicle of any value any vehicle more than 7 years old is not counted.

The following is a list of exempted resources in assessing a Medicaid applicants eligibility for Medicaid nursing home services. The short answer is that the mortgage is an asset and its value is the amount left to be paid on it not the original amount of the loan. This vehicle is excluded from the list of assets and is not regarded as a countable asset according to Medicaid rulings so this is one way to spend down.

In general a car is considered an exempt asset for Medicaid. And if the transaction is for fair market value and a fair interest rate there should be no transfer-of-asset issue if it is taken out within the five years before applying for Medicaid. Personal property The one caveat here is that like the extravagant car noted above spending too much on items like jewelry or art could be considered an investment and therefore a countable asset.

One car according to the policies of the program is a non-countable asset that will not be taken into the account of Medicaid while taking stock of your countable assets. Automobile Not Exempt When a Medicaid client owns a vehicle which does not fall into one of the five exemption categories listed above the vehicle is considered an asset of the clients estate. In the case of a married couple the community spouse the one who is not in the nursing home also gets to keep an exempt vehicle.

Is a car an asset for medicaid Saturday February 26 2022 Edit. In Illinois there is a limit of 4500 unless the vehicle is used or equipped for medical transportation. However a Medicaid caseworker may consider an extravagant purchase an exotic or luxury car to be a investment and therefore a countable asset.

Cars or other motor vehicles if you have more than one Department of Health and Human Services also indicates that some assets which are typically not considered to be countable assets for purposes of determining if you can qualify for Medicaid include. In addition if the individual does not have funeral arrangements already made this can be a great way to plan ahead and reduce assets. Can my mother gift her car to my daughter without worrying about the five-year look-back period if she applies for Medicaid.

If this rule has been violated a penalty period of Medicaid ineligibility is calculated. You can also exempt a second vehicle older than seven years old unless it is a luxury vehicle or it is an antique or classic car older than 25 years old. Funeral and Burial Funds Generally Medicaid considers the value of any non-refundable pre.

However the reality could be more complicated and. Your 2022 Guide To Medicaid Car Insurance Discover Why Changes Are Coming For Medicare Beneficiaries Find Out What You Need To Know About The New Medicare Card C. Currently the Florida Medicaid policy is to exclude one car of any value or use.

Medicaid also takes your vehicle into account as an asset and limits each Medicaid recipient to one non-countable vehicle in order to qualify. One automobile of any current market value is considered a non-countable asset for Medicaid purposes as long as it is used for the transportation of the applicant or another member of their household. The Look-Back Period will be implemented for home and community based long-term care services.

This implies that Medicaid insurance will not count some assets in its checklist to see if the Medicaid applicant qualifies. A The answer is probably yes but it depends on the circumstances. Eligibility for medical assistance.

Can I own a car and qualify for Medicaid. Rule means any vehicle used for transportation. If you own a car you can rest assured Medicaid is not going to hold it against you no matter how much it costs.

If by chance the do count the value of the second car they will probably be using the tax value and if you are making payments on the second car the loan balance can be used to reduce the countable value of that vehicle. This will result in eliminating the value of most vehicles over 7 years old. You have to be familiar with Medicaid in your state to know when not to buy a car while on Medicaid.

One automobile of any current market value is considered a non-countable asset for Medicaid purposes as long as it is used for the transportation of the applicant or another member of their household. For a single or widowed applicant Missouri says that you can have as exempt a vehicle of any reasonable value. Any value over 4500 is counted toward the 2000 total assets limitation.

Arkansas allows you to have one car. The look back is intended to discourage persons from gifting assets to meet Medicaids asset limit. This means you can own one Bentley worth over 100000 and that vehicle would.

A The answer is probably yes but it depends on the circumstances. The primary home or residence where you live. As a Medicaid recipient you are allowed to have only one car.

This is where it can be beneficial to take advantage of assets that are excluded. So either way you should be fine. You can own an automobile and qualify for Medicaid.

Motorcycles boats snowmobiles animal-drawn vehicles and animals. Funeral and Burial Funds Generally Medicaid considers the value of any non-refundable pre-paid funeral plan or burial contract exempt. The applicants principal place of living is an excluded.

According to the Florida ESS Policy Manual Section 16400583 and Section 16400591 explain that a single automobile car truck motorcycle etc is excluded as an asset regardless of its value. Other vehicles are generally considered extra unless they are very damaged or undriveable.

Medicaid And Car Ownership What To Know Copilot

California Is Ending Its Asset Test For Medicaid Long Term Care Is It A Mistake

Medicaid Financial Eligibility For Seniors And People With Disabilities Findings From A 50 State Survey Issue Brief 9318 Kff

Medicaid Trust For Asset Protection From Nursing Home Costs

Learn How To Protect Your Assets From Medicaid Freedomcare

Using Asset Verification Systems To Streamline Medicaid Determinations Center On Budget And Policy Priorities

Are You Exposed To The New Jersey Estate Tax New Jersey Jersey Diploma Design

5 Ways To Protect Your Money From Medicaid Elder Care Direction

Harmer Hybrid Platform Lift Al600 Mobility Scooter Handicap Lifts Lifted Cars

Is A Financed Vehicle An Asset Mediation Advantage

Mortgage Insurance Ordering Made Seamless As Openclose Integrates Its Lenderassist Los With Radian Send2press Newswire Mortgage Radians Business Intelligence

What Assets Are Exempt From Medicaid Plan Right Law

Did You Forget Something Savings Account How To Plan Estate Planning

Potential Changes To Medicaid Long Term Care Spousal Impoverishment Rules States Plans And Implications For Commun Medicaid Long Term Care Family Foundations